Why Choose IRSFillableForms.com?

With IRSFillableForms.com, you can have a great time creating your 941, 941-X, W-2, 1099-NEC, and 1099 MISC Forms, and also you can generate, download and print it instantly.

By using our service, you can enjoy the hassle-free service of electronic filing and overcome the hurdles involved in paper filing your tax forms. E-file your Form 941 return at just $5.95/Form, and W-2, 1099-NEC, or 1099-MISC and other 1099 form 2023 starts at just $0.80/return.

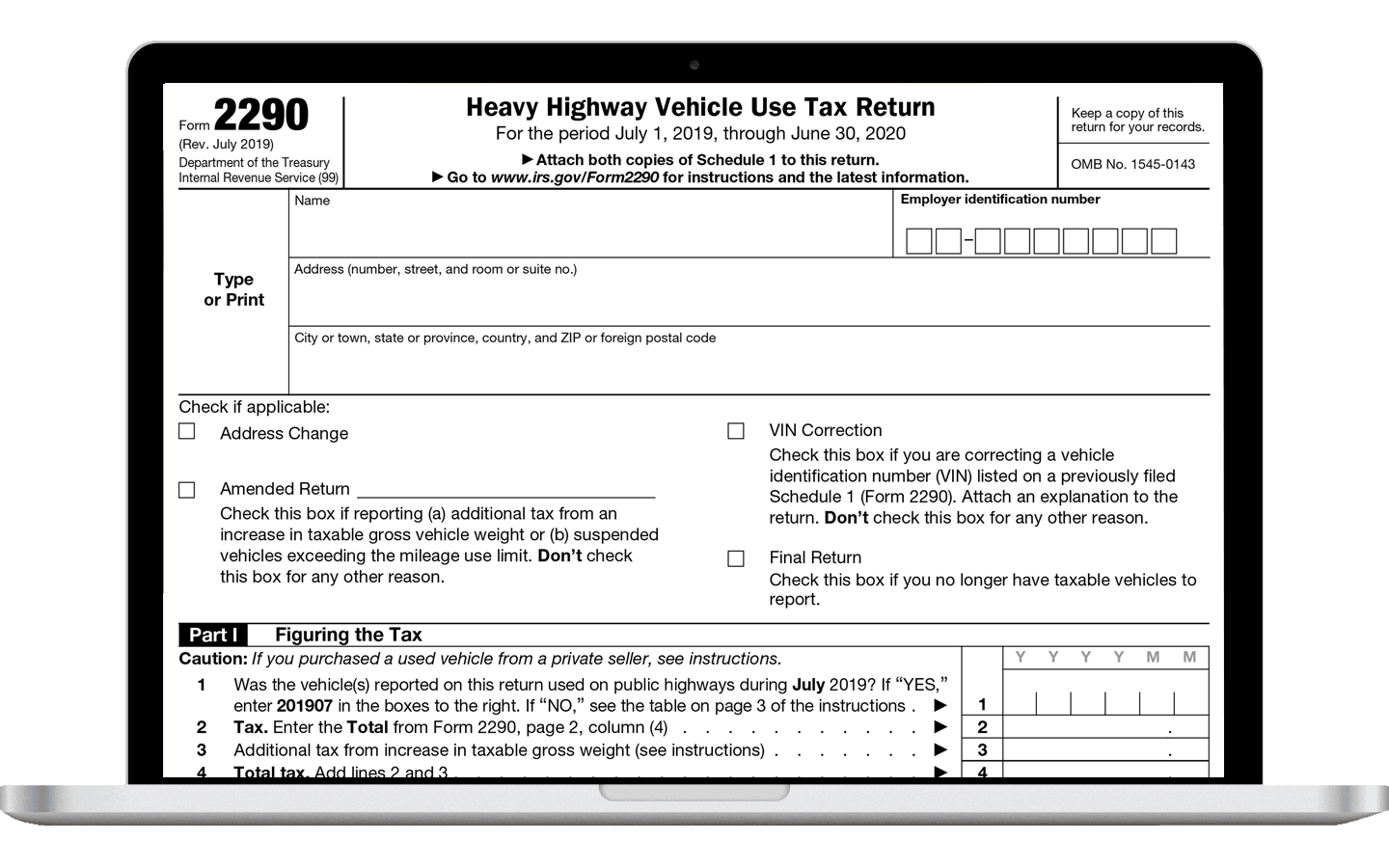

Form 2290, Heavy Vehicle Use Tax

Anyone having heavy highway motor vehicles with taxable gross weight of 55,000 pounds operating on public highways need to pay Heavy Vehicle Use Tax (HVUT) and report the tax using Form 2290 annually.

While filing Form 2290, the IRS will issue Schedule 1 as the proof of HVUT payment.

With IRSFillableForm.com -

- Just fill in the Form 2290 information as you fill out a physical form.

- Edit your Form 2290 information at anytime before filing it to the IRS.

- E-file Form 2290 with the IRS for just $6.90. You will receive your stamped Schedule 1 in minutes.

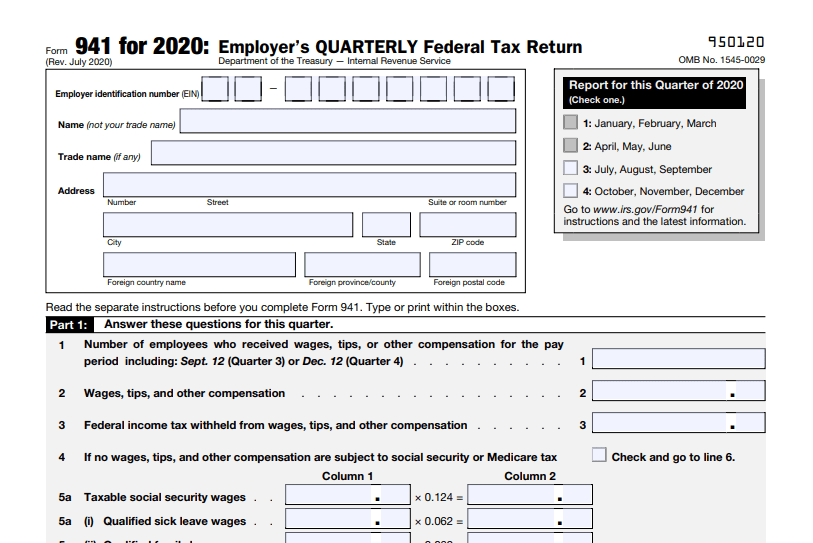

Form 941, Employer’s QUARTERLY Federal Tax Return

IRS 941 Form is used to report quarterly wages paid to employees and withholdings made by employers. It also includes FICA (Medicare and Social Security taxes) during the reporting period. Employers must mail a paper copy of Form 941 or e-file 941 Forms to the IRS.

With IRSFillableForms.com -

- Use our preloaded fillable 941 Form, enter Form values, and generate a copy of it.

- You can generate unlimited IRS 941 Tax Forms and can edit the form information at any time before filing it with IRS. After generating your Form 941, preview and e-file it with the IRS securely. You will receive the status of your return once it is processed by the IRS.

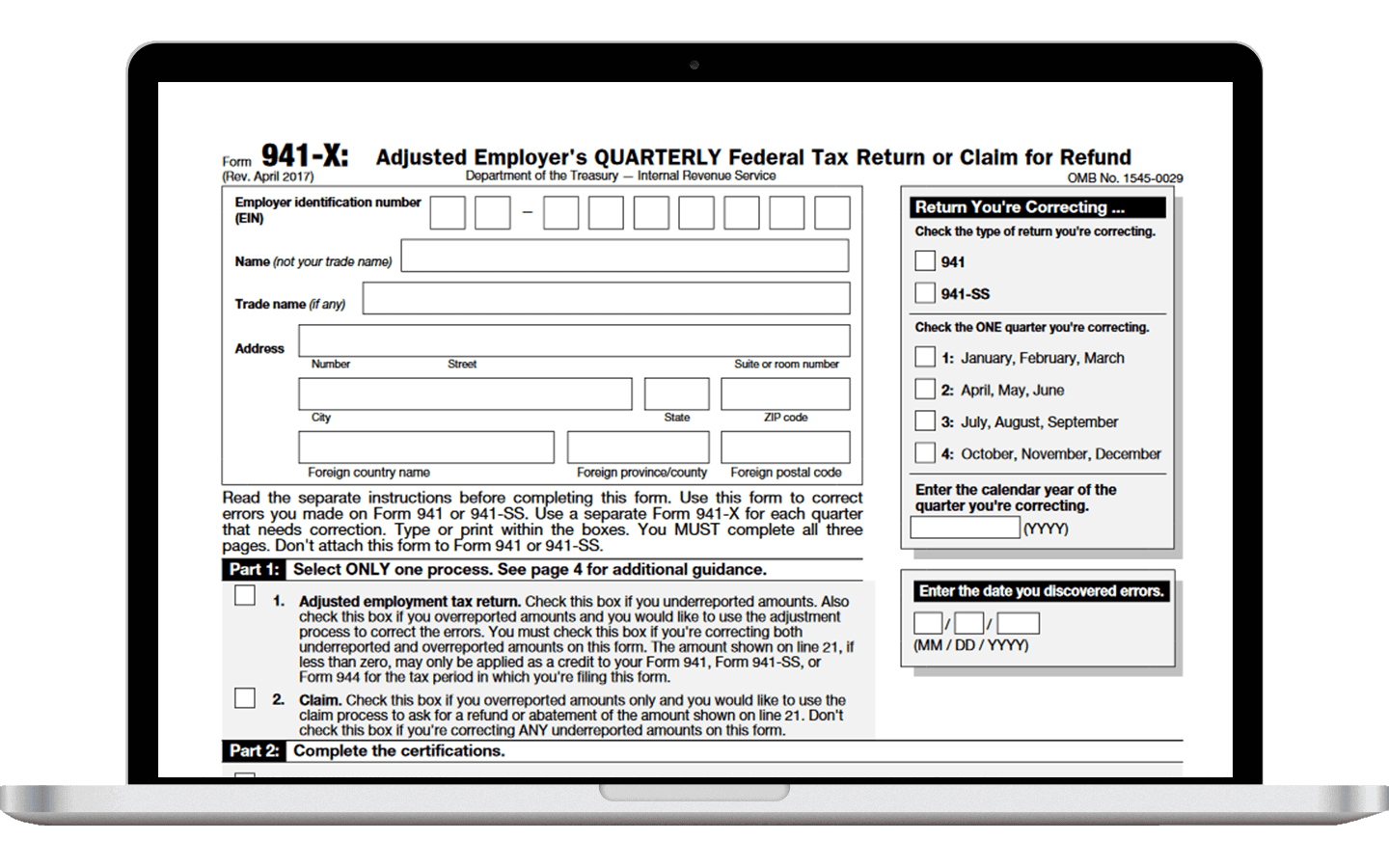

Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund

Form 941-X is used to fix any errors made on Form 941. If you discovered an error on a previously filed Form 941, you can amend the Form 941 using Form 941-X. You need to file Form 941-X separately for each tax period in which you find out there was an error.

If you underreported tax, you’ll need to pay taxes along the Form. If you overreported tax, you may choose to claim a refund or abatement for your next return.

If you are requesting a refund or abatement and you are correcting both underreported and overreported taxes, you need to file one Form 941-X to correct the underreported taxes and another 941-X form to correct the overreported taxes.

With IRSFillableForms.com -

- You can enter the Fillable Form 941-X details, download and print for free. And mail it to the IRS

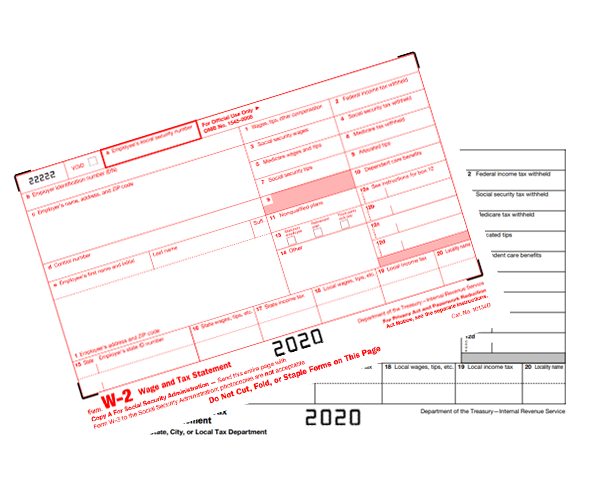

Form W-2, Wage and Tax Statement

It is the responsibility of employers to report all wages, compensations, and salaries provided to employees for which federal income and other taxes are withheld to the IRS using

Form W-2. In addition, IRS also mandates that employers need to issue copies of Form W-2 to their employees.

With the option provided by IRSFillableForms.com -

- Enter the form information as you would fill out a physical form, but with the IRS business validation.

- You can edit the form at any time and generate unlimited Form W2.

After generating, you can preview and e-file your W-2 Forms with us at $1.49/form.

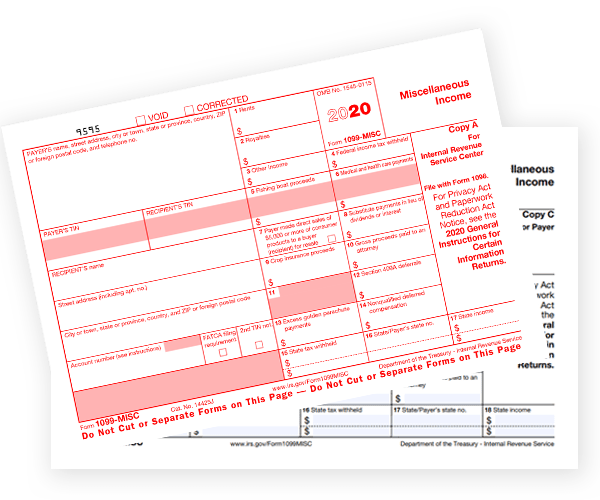

Form 1099-MISC, Miscellaneous Income

IRS 1099 tax Form MISC is used for reporting the payments or miscellaneous income of non-employees for a business. Miscellaneous income consists of payments made for awards, prizes, rental payments, substitute payments, independent contractors and subcontractors. These payments which you make to individuals who aren’t classified as employees are called as nonemployee compensation. Also, employers must use the 1099-MISC Form for all nonemployees who were earning more than $600 in the previous tax year.

With IRSFillableForms.com -

- You can quickly generate the fillable 1099-MISC Forms, preview, and e-file them with the IRS.

- You can edit the form at any time and generate unlimited IRS

Form 1099-MISC.

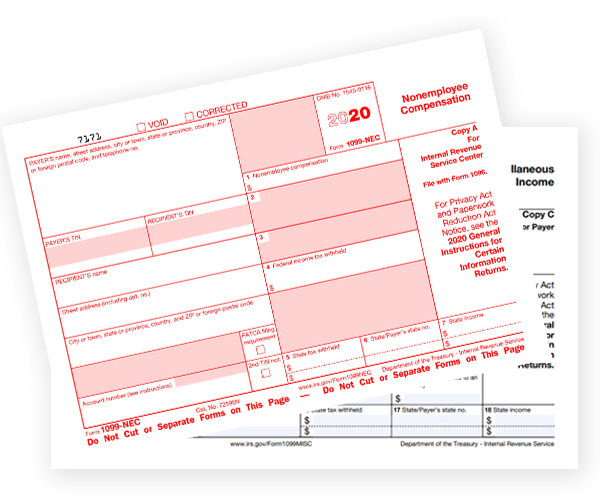

IRS Form 1099-NEC

IRS Form 1099-NEC is filed by payers to report nonemployee compensation paid to independent contractors during a tax year. The IRS has introduced Form 1099-NEC for the 2020 tax year to report nonemployee compensation alone. Earlier, it was reported in Box 7 of Form 1099-MISC. If you have paid at least $600 to a contractor as compensation, you are required to

file Form 1099-NEC. Also, recipient copies should be furnished to contractors before the 1099 deadline 2023.

With IRSFillableForms.com -

- You can quickly generate the fillable 1099-NEC Forms, preview, and e-file them with the IRS.

- You can edit the form at any time and generate unlimited 1099 Form.

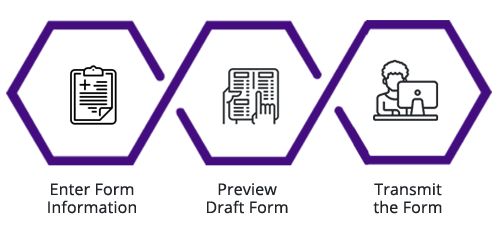

Steps to Create Free Fillable Forms:

It is easy to create 941, 941-X, W-2 and 1099-MISC Forms with IRSFillableForms.com.

Other Supported Forms

- Form 1099-K, Form 1099-MISC, Form 1099-NEC, 1099-INT, 1099-DIV, R, S, G, C, B, PATR & other 1099 Forms

- Form 1095-B/C, 941-PR, 941-SS

- Form W2, W-2c, W-2PR, W-3

- Form 941, 941-PR, 941-SS

- Form 990-N, 990-EZ, 990, 990-PF & 1120-POL

- Form 8868, Form 8809

Pricing

Choose the plan that’s right for your business

| Type of Services | No. of Forms (per form pricing) | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| First Form | Next 3 Forms | 5-25 Forms | 26-50 Forms | 51-100 Forms | 101-500 Forms | 501-1000 Forms | 1000+ Forms | ||

|

Forms 940, 941, 943, 944, 945

Pricing includes Schedule B, Schedule A, 8453-EMP, 8974 |

$5.95 | $5.25 | $4.75 | $4.25 | $3.75 | $3.25 | $3.00 |

Contact Us for Bulk Pricing 704.684.4751 Request Quote |

|

| Form 941-X, Form 940 Amendment | $2.99 | $2.99 | $2.99 | $2.99 | $2.99 | $2.99 | $2.99 | ||

| Type of Services | No. of Forms (per form pricing) | ||||||

|---|---|---|---|---|---|---|---|

| First 10 Forms | Next 90 Forms | 101 - 250 Forms | 251 - 500 Forms | 501 - 1000 Forms | 1000+ Forms | ||

| W-2 / 1099 Federal E-File | $2.75 | $1.75 | $1.15 | $1.00 | $0.80 |

Contact us for Bulk Pricing 704.684.4751 Request Quote |

|

| W-2 / 1099 State E-File | $0.70 | $0.70 | $0.70 | $0.70 | $0.70 | ||

| Postal Mail | $1.50 | $1.50 | $1.50 | $1.50 | $1.50 | ||

| Tax Form Access | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | ||

| W-2c / 1099 Corrections | $2.75 | $1.75 | $1.15 | $1.00 | $0.80 | ||

| 3921 / 3922 Federal E-File | $2.75 | $1.75 | $1.15 | $1.00 | $0.80 | ||

| 1042-S Federal E-File | $2.75 | $1.75 | $1.15 | $1.00 | $0.80 | ||

| TIN Matching | $19.99/Business (Unlimited for 1 year) | ||||||